“FinTechs & Banks…whoever gets the client experience right between FinTech and Banks will win in terms of ROI, EPS, and Shareholder value…”“FinTechs & Banks…whoever gets the client experience right between FinTech and Banks will win in terms of ROI, EPS, …

Introduction to SM+Co LLC – Technical Accounting and Risk Advisory Services

SM+Co LLC Introduction VideoSM+Co LLC Introduction Video

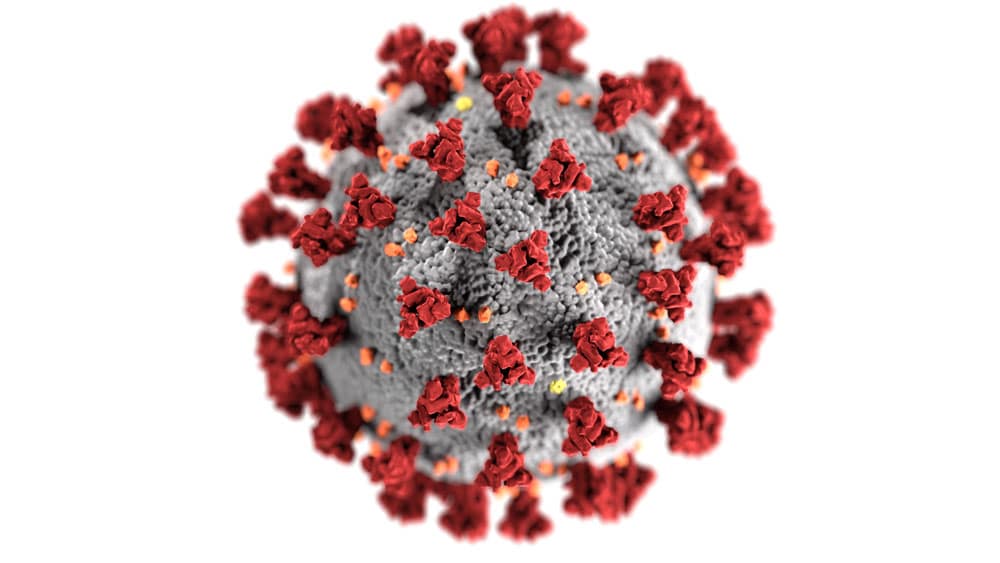

Coronavirus Disrupts Historic Credit Loss Accounting Overhaul

At the end of 2019, as the biggest change to bank accounting loomed, bankers took comfort in one fact: they’d at least get to overhaul how they calculate losses on loans during a stable, relatively predictable economy. The coronavirus pandemic …

Banks Look to Lessen Credit Loss Standard’s Effect on Regulatory Capital

FASB News Banks Look to Lessen Credit Loss Standard’s Effect on Regulatory Capital Topic(s): FASB, GAAP, Financial Reporting, Disclosure, Specialized Industries, Regulated Industries, Risk, Debt, Equity, Derivatives, Financial Management Summary: Banks want federal banking regulators to make it easier to …

FASB adjusts CECL deadline for private banks

Excerpt From: https://www.accountingtoday.com/news/fasb-adjusts-cecl-deadline-for-private-banks-and-credit-unions FASB adjusts CECL deadline for private banks By Michael Cohn | Accounting Today July 27, 2018, 4:06 p.m. EDT …Stephen V. Masterson, national leader of the firm’s U.S. Financial Institutions Advisory Services practice, sees the move as a …