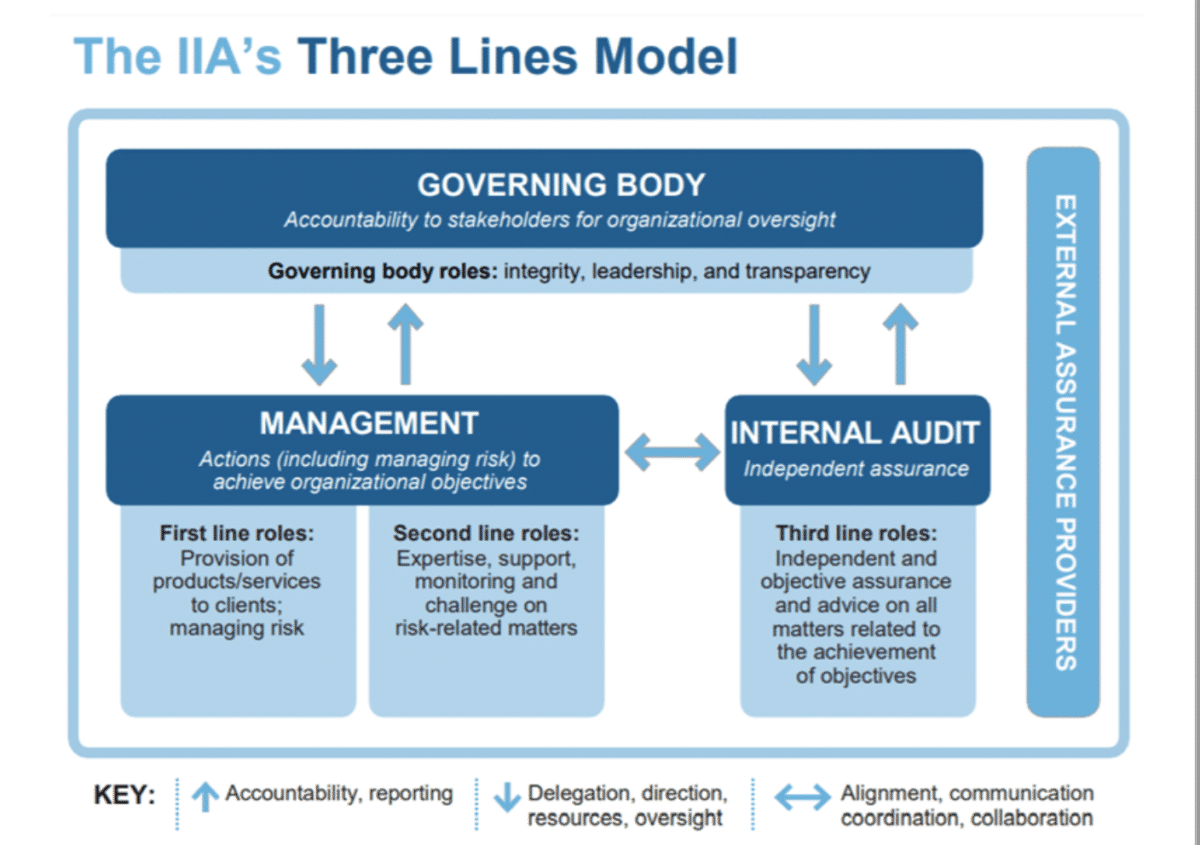

The new model’s principles-based approach is designed to provide users greater flexibility,” Chambers wrote. “Governing bodies, executive management, and internal audit are not slotted into rigid lines or roles. The ‘lines’ concept was retained in the interest of familiarity. However, they are …

Coronavirus Disrupts Historic Credit Loss Accounting Overhaul

At the end of 2019, as the biggest change to bank accounting loomed, bankers took comfort in one fact: they’d at least get to overhaul how they calculate losses on loans during a stable, relatively predictable economy. The coronavirus pandemic …

Banks Look to Lessen Credit Loss Standard’s Effect on Regulatory Capital

FASB News Banks Look to Lessen Credit Loss Standard’s Effect on Regulatory Capital Topic(s): FASB, GAAP, Financial Reporting, Disclosure, Specialized Industries, Regulated Industries, Risk, Debt, Equity, Derivatives, Financial Management Summary: Banks want federal banking regulators to make it easier to …

FASB adjusts CECL deadline for private banks

Excerpt From: https://www.accountingtoday.com/news/fasb-adjusts-cecl-deadline-for-private-banks-and-credit-unions FASB adjusts CECL deadline for private banks By Michael Cohn | Accounting Today July 27, 2018, 4:06 p.m. EDT …Stephen V. Masterson, national leader of the firm’s U.S. Financial Institutions Advisory Services practice, sees the move as a …

Sarbanes-Oxley Smart Companies Are Figuring Out How to Find the Silver Lining

Read full PDF- Click Here- Masterson BusinessWeek GT